Collaboration type: One-off project (2 occassions)

Vertical: fintech, payments, open banking, checkout solution

Timeframe: 2022 and 2024

Overview

Volume is a London-based payments fintech startup leveraging open banking technology to eliminate excessive transaction fees and improve online payment experiences. The company offers an account-to-account (A2A) payment solution that bypasses traditional card networks, reducing costs for merchants and streamlining the checkout process. Backed by top investors, including United Ventures, Fabrick, and Firstminute Capital, Volume is shaping the future of online payments.

Challenge

As a growing fintech startup in a competitive payments landscape, Volume needed to maximise the visibility of its fundraising rounds. The goal was to secure strategic media coverage that would not only highlight the investment but also position the company as a leader in A2A payments. Volume wanted to ensure that its funding news stood out amid broader industry trends, such as the collapse of Fast, while emphasising its differentiation in terms of scalability, revenue, and real-world adoption.

Solution

Black Unicorn PR worked with Volume on two major fundraising announcements: its $2.4M pre-seed round and its $6M seed round. The PR strategy centered on securing high-impact media coverage and crafting narratives that positioned Volume as a standout success in A2A payments.

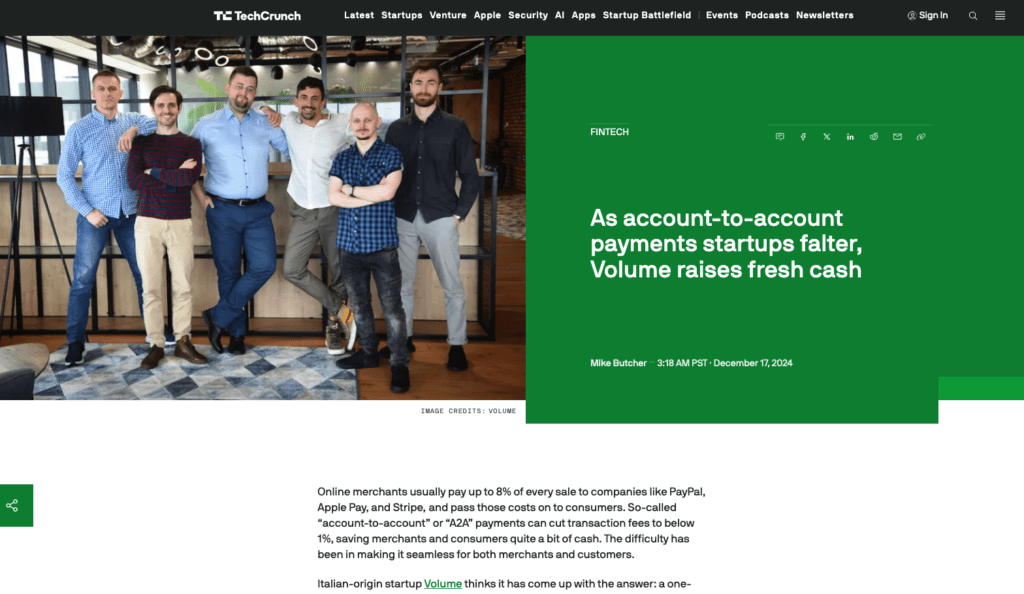

To maximise visibility, Black Unicorn PR secured TechCrunch exclusives for both funding rounds, ensuring that the news reached the most influential readers in the startup ecosystem.

$2.4 million pre-seed on TechCrunch

$6 million seed round on TechCrunch

Rather than relying only fundraising announcements, we also sought to capitalise on these with follow-on opportunities. In addition, we positioned the funding news within global industry trends, helping journalists and audiences contextualise. The first announcement strategically contrasted Volume’s real-world traction with the struggles of failed competitors like Fast, making it clear that A2A payments could be scalable, profitable, and a true alternative to traditional payment systems.

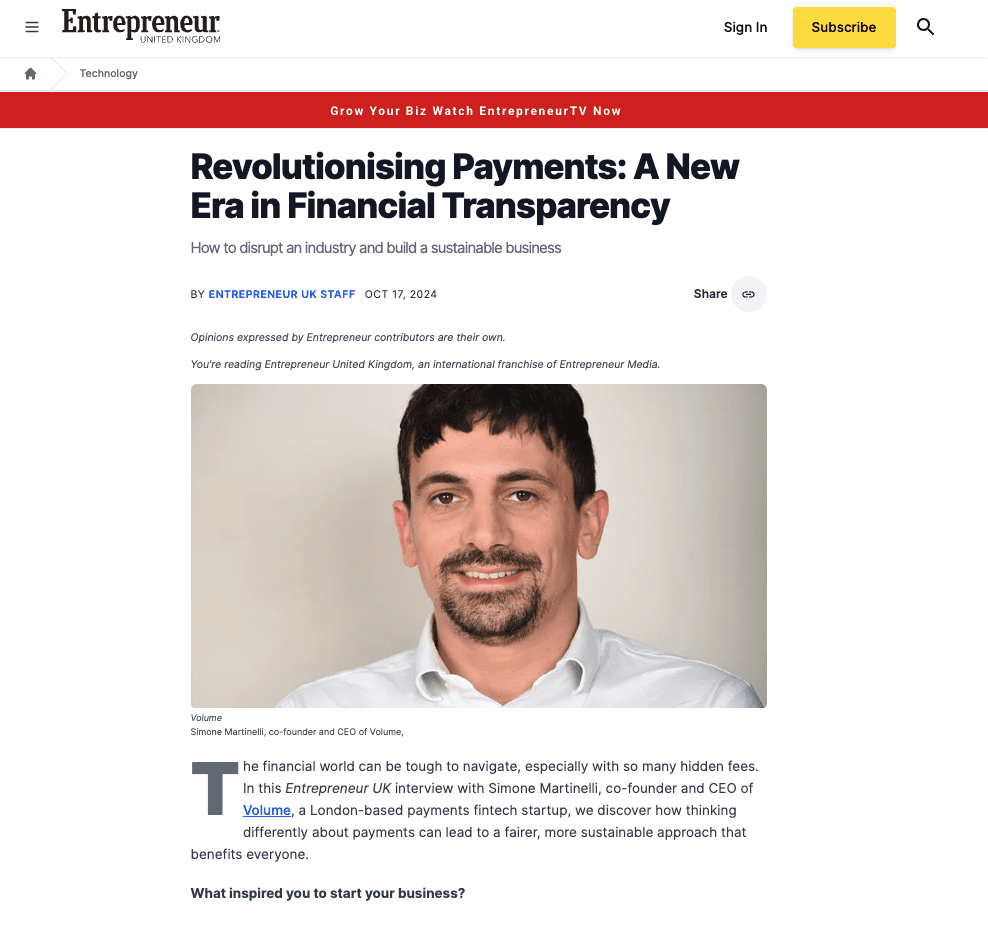

Beyond the funding announcements, additional media wins included coverage of product launches, a founder profile in Maddyness UK, an interview with co-founder Simone Martinelli in Entrepreneur UK, and a thought leadership article on open banking published in NASDAQ.

Results

With Black Unicorn PR’s support, Volume secured TechCrunch exclusives for both pre-seed and seed funding rounds, amplifying their reach among key stakeholders such as investors, partners and regulators in the fintech and startup space. Additional features in reputable outlets such as Maddyness UK, Entrepreneur and NASDAQ helped further establish Volume’s thought leadership and credibility. For each activity, key messages were closely coordinated with the client, and successfully transmitted by the published articles.

As well as the notable articles mentioned above, the funding and product launch outreaches yielded over 100 articles on publications across media verticals such as startup, fintech and tech, not just in the UK, but also in globally-oriented and Italian publications.

Interested in achieving similar results? Work with us! Just drop us a note and we’ll schedule a coffee chat!

Further case studies: