Collaboration type: Long-term

Vertical: fintech, open banking

Timeframe: 2020-2022

About Nordigen

Nordigen is a freemium open banking platform that provides access to open banking data and premium data insights. Nordigen’s API connects to more than 2300 banks in the UK and Europe, and serves fintech companies and developers in 31 countries. Nordigen is a licensed Account Information Service Provider (AISP), regulated by the Financial and Capital Market Commission of Latvia and authorised in 31 European countries. In April 2023, Nordigen’s product was relaunched as GoCardless Bank Account Data.

Context and objectives

We started working with Nordigen at a moment in time when open banking was ‘the hot new thing’ that new regulation in Europe enabled (and forced). The fact that banks had to make certain connections available gave rise to a number of startups that could act as pipes, or infrastructure for bank API calls, meaning pulling data or enacting payments. Some of the leading players were already established, like Plaid in the US, or TrueLayer and Tink in Europe. Open banking, because of its promise and the regulatory aspect of mandatory PSD2 implementation, occupied a significant space in media discussions, although many struggled to make sense of it or understand it fully, given the technicalities around it.

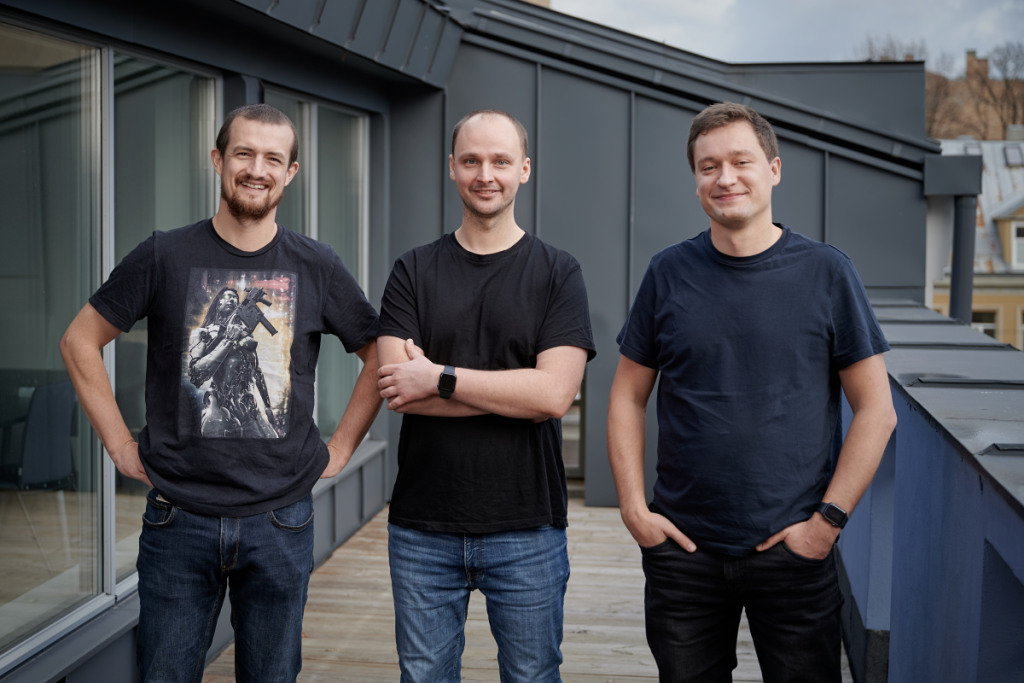

Nordigen entered the open banking platform space later than some competitors, initially focusing more on enriching open banking data rather than acting as an API provider. Despite its strong product, the company had been relatively quiet in international media and was dissatisfied with its previous PR strategy and agency. Challenges included entering the media conversation later than competitors and being the only startup in its cohort based in Central and Eastern Europe (although we, and Baltic countries prefer Northern Europe, or the New Nordics).

Black Unicorn PR took on the challenge of positioning Nordigen clearly within the open banking landscape. Our goal was to help all the relevant stakeholders understand its business, build trust in the company, and introduce its leadership to the world. Leaders driven by a mission to advance fintech innovation, and true believers in the power of open banking. We also worked to establish them as thought leaders in the open banking space, particularly Rolands, with contributed content and guest appearances on podcasts.

Summary and Results

In a short span of time, we positioned Nordigen as an innovative force in open banking and established their co-founder and CEO, Rolands Mesters, as a leading voice in the space. We secured high-profile speaking opportunities for him on platforms such as The Banker and 11:FS, as well as features in publications like Sifted. A key milestone in our collaboration was the launch of Nordigen’s freemium open banking platform, spearheaded by a TechCrunch exclusive.

The thought leadership strategy was supercharged (right from the start, to be honest) when we uncovered one of Nordigen’s biggest assets: Rolands’s exceptional ability to explain open banking in clear, simple terms. And this at a time when the concept was still rather murky to journalists and those outside fintech’s technical circles.

Our eureka moment came during an onboarding meeting when Rolands sketched a diagram on a whiteboard, breaking down open banking in a way that instantly made sense. Despite having consumed countless podcasts and articles on the topic, this was the first time it all truly clicked (at least for me, writing this case study). That’s when we knew we had to get him to do the same (minus the in-person whiteboard) for journalists and industry audiences (via media).

Beyond thought leadership, we helped Nordigen gain recognition for its game-changing, freemium model that would defy incumbents. Nordigen had namely built its own lightweight open banking platform, competing with incumbents (on data, not payments) in a bid to disrupt the market. This was a game changer for companies with big open banking service costs and also allowed new companies to emerge building on open banking data. This product launch, but way more than a product launch, would help Nordigen stand out and attract customers, despite the vast size difference between them and other players. The bold move ultimately paved the way for Nordigen’s acquisition by GoCardless.

Thought leadership

We quickly recognized the opportunity to demystify open banking in the media by leveraging the strong explanatory skills of Nordigen’s co-founder and CEO, Rolands Mesters. Our strategy centered on positioning Rolands as a go-to expert, building key media relationships, and establishing him as a trusted source for commentary on open banking developments. After the first call we scheduled with a fintech journalist, we got the following feedback from the journalist: “This has been one of the best calls on open banking I ever had”. OK!

Notable placements:

https://sifted.eu/articles/open-banking-valuations

https://sifted.eu/articles/plaid-europe-fintech-expansion

https://sifted.eu/articles/mastercard-tink-investment-fintech

https://sifted.eu/articles/eastern-europe-startup-predictions-2022

We also worked to position Rolands as a key spokesperson for the broader Latvian fintech scene. This included securing high-profile appearances, such as his guest spot on 11:FS’s Fintech Insider, one of the most influential fintech media platforms, during a special pandemic episode, as well as his feature on The Banker following the launch of Nordigen’s freemium open banking platform.

Another key narrative we worked on was the defense of open banking. A recurring media discussion centered on how many, or how few, people had adopted open banking. Commentators often judged its success based on adoption rates and the time elapsed since PSD2 was introduced, with some declaring open banking a failure. Even prominent fintech figures, such as Anne Boden of Starling, voiced skepticism.

We engaged in these debates alongside Rolands, consistently advocating for open banking’s long-term potential. We highlighted how it wasn’t just benefiting existing companies but also creating entirely new businesses by unlocking fresh opportunities. Our message was clear: open banking was still in its early days, and its impact was only beginning to unfold.

Notable placements:

https://www.altfi.com/article/8531_open-banking-is-not-a-flop

https://www.verdict.co.uk/open-banking-starling

Sadly, AltFi closed down in 2024. Screenshot obtained from Wayback Machine.

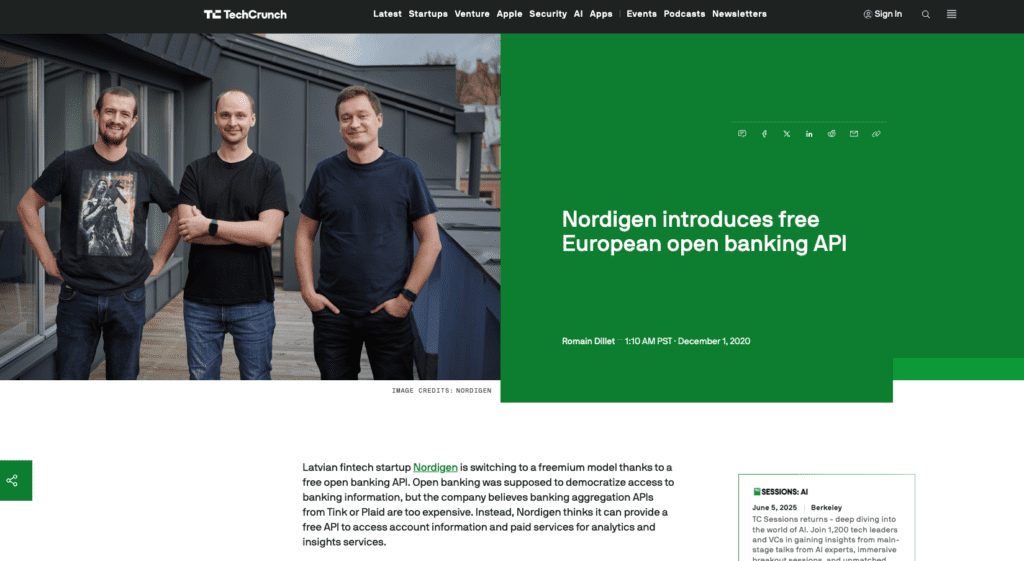

Nordigen’s freemium platform

A few months into our collaboration, the Nordigen team revealed they had been working on their own open banking platform, with a game-changing twist: it would be completely free. While existing players charged clients per API call, Nordigen’s technical team had found a way to offer the service at no cost. Unlike incumbents that had built their infrastructure years earlier and couldn’t afford to take this approach, Nordigen leveraged the latest technology to bypass those costs. Despite the disruptive pricing model, Nordigen’s platform matched or even outperformed competitors in speed, geographical coverage, and bank connections. And this wasn’t just a bold experiment. Nordigen had a clear strategy. The free platform would serve as an entry point, allowing the company to upsell value-added data services.

Securing TechCrunch for an early-stage startup is not easy. And without funding in the story, even harder. However, we helped Nordigen land the story of this product launch. How? By ensuring Nordigen’s launch wasn’t seen as just another product announcement. Instead, we framed it as a pivotal moment for open banking. One that challenged industry norms, reshaped perceptions of what was possible, and redefined the economics of the open banking platform model. Of course, it’s easier said than done. A lot of work went into proving th significance of the platform.

Notable placements:

https://techcrunch.com/2020/12/01/nordigen-introduces-free-european-open-banking-api/

https://emerging-europe.com/business/from-latvia-the-first-free-open-banking-api/

https://www.fintechfutures.com/2020/12/nordigen-unveils-free-open-banking-platform-to-industrys-dismay/

https://www.finextra.com/pressarticle/85243/nordigen-launches-free-open-banking-platform-to-challenge-tink-and-plaid

Interested in achieving similar results? Work with us! Just drop us a note and we’ll schedule a coffee chat!