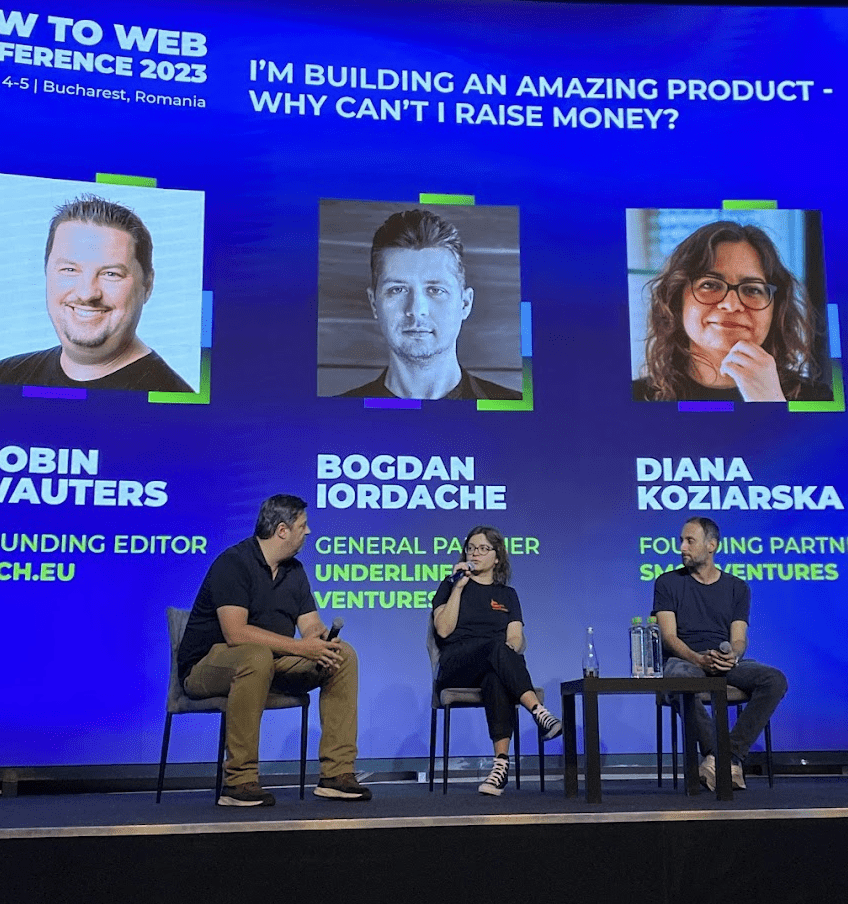

The second panel we followed closely at How to Web was moderated by Robin Wauters of tech.eu. The talk dealt with a question that very likely resonates with many founders of beautiful babies: “Why can’t I raise money if I have a great product?”

Bringing their expertise to the table were three prominent venture capitalists: Diana Koziarska from SMOK VC, Kaan Eren from 500 Emerging Europe, and Bogdan Iordache of Underline Ventures (by the way also founder of How to Web).

Beyond Product Excellence: The Prerequisites for Funding

A great product, as the panel highlighted, is not merely about its intrinsic qualities. It’s about how the market perceives it. (In other words, your baby will always be beautiful to you). Before being convinced of having a great product, founders should ensure that their offering is universally acknowledged as such, which actually requires consistent interaction with clients.

Additionally, while research, presentations and speaking skills are valuable, founders must wear the builder’s hat and actually demonstrate domain knowledge, experience and expertise. They need to show that they can make it, and not just in their home country. This international mindset and the ambition to scale beyond local boundaries make a substantial difference.

Team Dynamics and Validation

The essence of a successful startup often boils down to its team. The panel unanimously agreed on the significance of team validation. A venture’s success trajectory is as much about the people behind it as the product they offer.

When highlighting traits they seek in a team, Diana introduced the concept of a “cockroach superhero” (we love this term) – a founder who not only dreams of global conquest but is also resilient enough to navigate the most challenging circumstances. The ideal team, in this context, would have members who are adaptable, perseverant, resilient to any setback and possess an unwavering belief in their mission.

Timing, Traction, and the Art of Survival

While many founders pride themselves on their product’s uniqueness, Diana pointed out that timing is crucial. Sometimes, even a stellar product might lack the traction required to woo investors due to a number of circumstances. In such instances, startups might need to consider a bridge round or strive for breakeven – not the most glamorous route, but perhaps a necessary one.

Kaan emphasised the importance of refining the fundraising process, increasing its efficacy and expanding its scope. Fundraising is in itself an activity worthy of upskilling in. It may be that founders need to acknowledge they need to work on their own structures, frameworks and strategies to improve the fundraising side and develop that fundraising muscle.

Market Potential and Profitability Insights

Bogdan delved deep into the implications of product usage. He pointed out that who uses the product and how they use it could provide vital clues about potential competitors and the magnitude of the problem the product addresses. This insight helps VCs gauge the product’s potential in terms of exit opportunities or future valuations.

A fundamental question that founders should be prepared to answer is the pathway to profitability. After all, as the panel noted, companies often fail due to a lack of product-market fit, not merely because they run out of capital. Given shifts in the industry, startups should be ready to survive longer in order to eventually find PMF.

Summary – reasons why founders with great products might struggle to raise

🦉 The team is not experienced enough

🥇 The founders don’t demonstrate the right motivation

🏋♂️ The founders don’t showcase their resilience

🤏 Market size is too small

💪 Fundraising muscle not developed enough

Check out our other blog posts on How to Web 2023!